In July, CMS hinted at the possibility of a MACRA delay or some restructuring of the proposed rule to decrease the burden of compliance. On September 8, CMS explained this flexibility. The final ruling is expected to be available in November.

Here is what we know so far:

– The compliance date has not changed. On January 1, 2017 MACRA will change how CMS pays practices which provide care to Medicare beneficiaries. Physicians can take part via Merit Based Incentive Payment System or Alternative Payment Models. 2017 will be the first reporting year for payment adjustments in 2019.

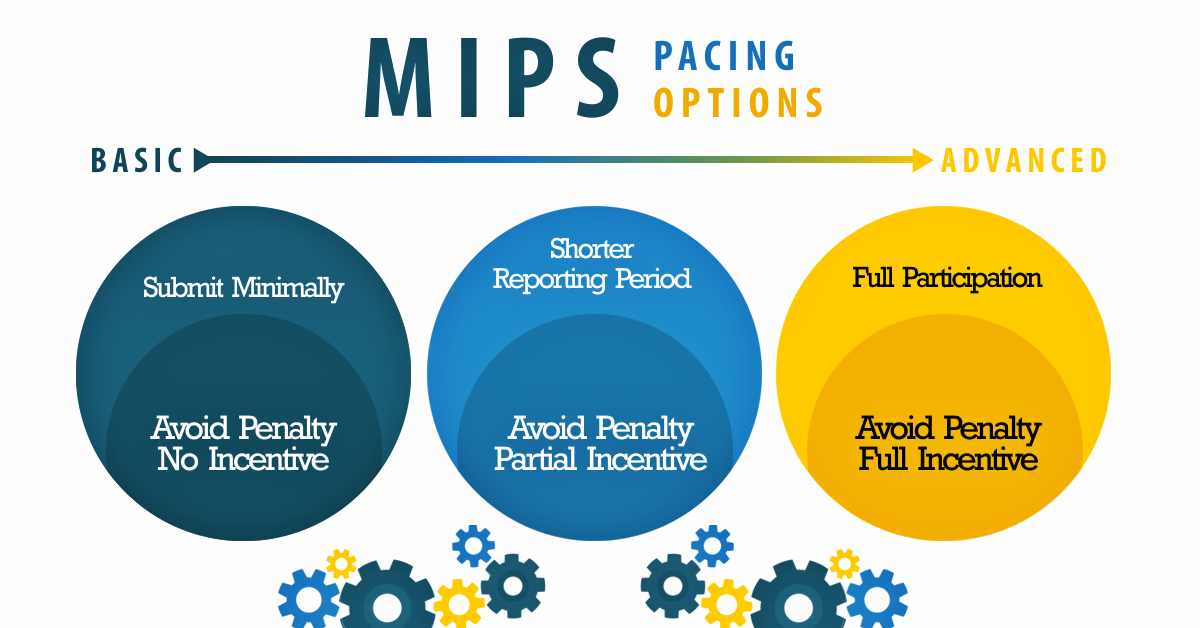

– CMS has created different levels of participation whereby practices will determine their own level and pace at which they will comply with MACRA. So far, this flexibility only applies to the first year of participation i.e. 2017, and by 2018 practices are expected to be in complete compliance with MACRA regulations.

To avoid incurring penalties for non-compliance with MACRA, participants can choose from anyone of the four options briefly described below:

Option 1: Minimal reporting

Financial Impact: Potential to avoid the 4% penalty, no chance for incentive

A group or individual will be able to avoid the 4% penalty to their 2019 claims, as long as they submit some Quality Payment Program data to CMS for the period after January 1, 2017. A full description of baseline submission requirements will be available in the final rule, scheduled for release in November 2016. Providers should be mindful that they will be expected to participate more comprehensively, for the 2018 and 2019 performance years, if they elect this option for 2017.

Option 2: Full participation with shorter reporting period

Financial Impact: Potential to avoid the 4% penalty and partial incentive (actual incentive percentage to be defined in November as a part of the final rule).

This option is best for clinicians who have reported PQRS data before, and are comfortable with the mechanism but are unsure about their ability to comply for a complete calendar year. It allows clinicians to report data to CMS for a period of time shorter than a full calendar year, so long as that custom reporting period begins after January 1,2017. Further information, such as, the minimum length of time that will constitute an “eligible reporting period”, will be available with the release of the final rule.

Option 3: Full MIPS Participation “Going all in”

Financial impact: Potential to avoid the 4% penalty and get a full incentive (up to 32%),

For practices that are prepared for MACRA on Jan. 1, they can submit data for a full calendar year and could qualify for a modest positive payment adjustment. “We’ve seen physician practices of all sizes successfully submit a full year’s quality data, and expect that many will be ready to do so,” Slavitt said.

Option 4: Participate in an advanced alternative payment model

Financial Impact: 5% incentive in 2019

Practices which receive a certain amount of Medicare payments or see a certain number of Medicare patients through the model could qualify for a 5 percent incentive payment in 2019.

Key Takeaway

“For “incentive seekers,” the true start date for MACRA is indeed Jan. 1, 2017. “For providers choosing the first option (some data) or the second (partial year), there effectively can be a later start to the performance period,”

Tom Lee, Ph.D., founder and CEO of Chicago-based consulting and software firm SA Ignite.

Further Reading:

The ABC’s of Merit Based Incentive Payment System

Reader Interactions